ZYN, a brand of tobacco-free nicotine pouches, has received a lot of attention in recent years and quickly gained traction.Originally from Sweden, ZYN was introduced to the United States by Swedish Match AB in 2014, and has quickly become the market leader in the U.S. nicotine pouch market.

ZYN?

Within the nicotine industry, ZYN Pouches have revolutionised the market with their innovative nicotine delivery. These products are popular for their smokeless formula, which combines pure nicotine extracted from tobacco leaves with food-grade ingredients and plant fibres. This clever design allows users to enjoy nicotine without the inconvenience and risk of smoking, spitting or using traditional tobacco products.

In the U.S. market, we see ZYN pouches available in a variety of flavours and nicotine strengths, typically 3mg or 6mg per pouch, catering to adult users looking for alternatives to traditional tobacco consumption methods.

While nicotine pouches offer a new way of ingesting nicotine, the health effects of their long-term use are not fully understood. Several studies have shown that regular nicotine intake, regardless of the method used, may have negative health effects. This is an area that requires continued research and vigilance.

Despite these concerns, ZYN and similar nicotine pouch products are a potentially less harmful alternative for nicotine-dependent adults, especially those who want to quit smoking. Nicotine Replacement Therapy (NRT) studies have shown that the use of NRT can improve the success rate of quitting smoking, and NRT is considered safe, even for people with heart disease, although a doctor should be consulted before using it.The purpose of NRT is to replace the nicotine obtained from cigarettes, reducing smokers’ cravings and helping them to stop smoking altogether.The use of NRT has been shown to improve the success rate of quitting smoking, and NRT has been shown to be safe even for people with heart disease, although a doctor should be consulted before using it.

Origins

ZYN is a brand of Swedish Match AB, a company with a rich history in the tobacco and nicotine products industry. The roots of Swedish Match can be traced back to the early 20th century, with its predecessors including Svenska Tändsticks AB (STAB) – once the world’s largest match manufacturer – and AB Svenska Tobaksmonopolet, which was established by the Swedish government to nationalize tobacco production.

Over the years, Swedish Match AB has established itself as a global leader in smokeless tobacco products, particularly Swedish snus. The company’s expertise in this area has been instrumental in developing innovative nicotine delivery systems like ZYN pouches. Their strong presence in both the US and Scandinavian markets is a testament to their product quality and market strategy.

ZYN is a brand of Swedish Match AB, a company with a rich history in the tobacco and nicotine products industry. The roots of Swedish Match can be traced back to the early 20th century, with its predecessors including Svenska Tändsticks AB (STAB) – once the world’s largest match manufacturer – and AB Svenska Tobaksmonopolet, which was established by the Swedish government to nationalize tobacco production.

Over the years, Swedish Match AB has established itself as a global leader in smokeless tobacco products, particularly Swedish snus. The company’s expertise in this area has been instrumental in developing innovative nicotine delivery systems like ZYN pouches. Their strong presence in both the US and Scandinavian markets is a testament to their product quality and market strategy.

The acquisition of Swedish Match AB by Philip Morris International (PMI) in 2022 for $16 billion was a significant move in the nicotine industry. This transaction catapulted PMI’s share in the global nicotine pouch market from nearly zero to 60% almost overnight. It’s a clear indication of the growing importance of smokeless nicotine products in the industry’s future.

PMI’s 2022 annual report highlighting ZYN’s “indefinite lifespan” due to its rapid growth and market leadership underscores the brand’s potential. This acquisition has positioned PMI as a major player in the smokeless nicotine market, aligning with the industry’s shift towards reduced-risk products.

From an investment perspective, it’s worth noting that ZYN, a brand owned by Sweden’s Match AB, is not a publicly traded company, but rather a subsidiary of PMI. This acquisition has indeed made it more challenging for investors to gain direct exposure to the nicotine pouch market, as Swedish Match was one of the few companies almost exclusively focused on this segment.

The acquisition of Swedish Match AB by PMI has indeed made it more challenging to invest directly in the nicotine pouch market. Swedish Match AB was one of the few companies almost exclusively focused on this segment. However, this move also signifies the growing importance of smokeless nicotine products in the broader tobacco industry.

Rise

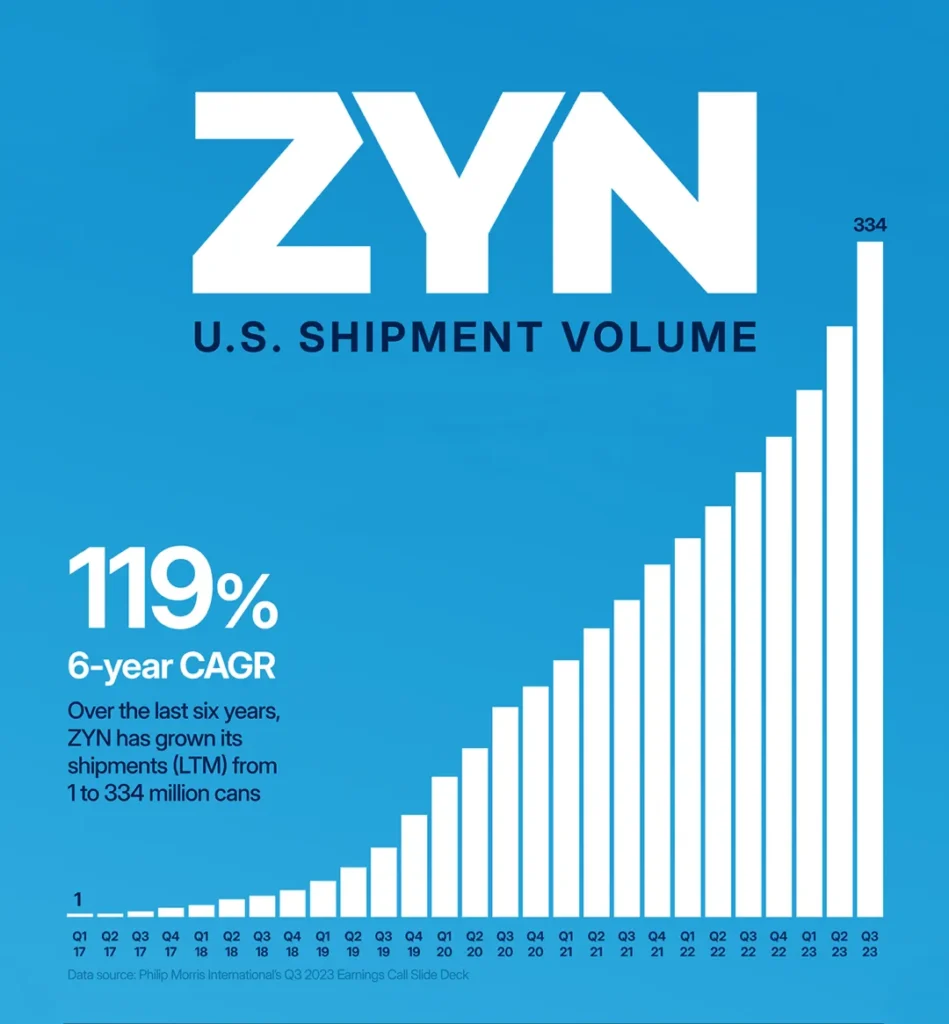

ZYN’s rapid growth in the U.S. market represents a shift in nicotine consumption trends.In Q3 2023, ZYN captured 76% of the retail market share in the U.S. nicotine pouch market, a figure that demonstrates its market leadership. Growing from 1 million cans six years ago to 334 million cans, ZYN’s CAGR has reached 119%, a growth rate that is significant in the global market. This growth not only reflects the market acceptance of ZYN’s products, but may also signal a long-term change in nicotine consumption habits.

A Booming Market

The rise of ZYN has certainly been a revolution. It is a business miracle that a product can go from nothing to a huge share of the market in just a few years, and ZYN is exactly such an existence, which has become a ‘game changer’ in the market with its unique charm and innovation.

- Expanding Production

PMI is investing $232 million to expand its Owensboro, Kentucky plant.

Another $600 million is being invested in a new plant in Aurora, Colorado. - Economic Impact

The Kentucky expansion will create 450 direct jobs and 410 indirect jobs.

It’s expected to generate $277 million in annual economic benefits.

During construction, it will create nearly 2,800 temporary jobs. - Increased Capacity

Kentucky plant will shift to 24/7 production starting Q4 2024.

Production capacity expected to reach 900 million cans by 2025.

Colorado plant will start operations in late 2025, with production beginning in 2026. - Market Demand

U.S. nicotine pouch sales grew by 80% in Q1 2024.

ZYN is the most popular brand, with reported shortages nationwide.

Some retailers have begun limiting purchases due to high demand. - Financial Performance

In H1 2024, PMI’s global nicotine pouch sales increased by 23.5%.

U.S. shipments reached 135.1 million cans, up 50.3% year-over-year.

Why are ZYN Pouches so Popular?

- Strong growth trend: According to the first quarter 2024 performance report released by Philip Morris International (PMI), the shipment volume of ZYN nicotine pouches reached 131.6 million cans, showing strong market demand and growth momentum.

- Diverse flavor options: ZYN offers up to 10 different flavors, including mint, citrus, coffee, etc., as well as two nicotine concentrations of 3mg and 6mg, meeting the personalized needs of different users.

- Convenient use: ZYN nicotine pouches are simple and convenient to use. Just place the pouch between the upper lip and gums, and nicotine can be absorbed through the oral mucosa. This pre-packaged pouch of nicotine does not require spitting, so it is deeply favored by those seeking alternatives.

- Concealment: The concealment of nicotine pouches makes it the first choice for those who want to inhale nicotine without attracting the attention of others. This concealment also makes ZYN nicotine pouches convenient to use in various occasions, increasing the flexibility of user use.

- Health considerations: As a smokeless, non-combustion product, ZYN nicotine pouches are considered to pose fewer health risks than traditional cigarettes. This is particularly popular among consumers who pursue a healthy lifestyle.

- Effective marketing: ZYN’s promotion strategy in the market, including promotion through social media influencers on platforms such as TikTok and Instagram, has successfully attracted the attention of young consumers.

- Economical: ZYN’s popularity on social media has also contributed to its popularity. So-called ‘Zynfluencers’ have praised the flavours on TikTok and podcasts, although Philip Morris International has stated that these influencers are not paid by the company.

- Changes in the regulatory environment: As regulations on traditional tobacco products become increasingly stringent, consumers and manufacturers are looking for compliant alternatives. Nicotine pouches such as ZYN are in line with this trend as a possible harm reduction option.

Dilemma

ZYN, the brand of nicotine pouches that has set the market on fire, has had its woes in the US recently:

- ZYN, the largest nicotine pouch brand in the US, the US Food and Drug Administration (FDA) started to investigate ZYN because the FDA did not authorise ZYN.ZYN applied for authorisation from the FDA in 2020, but the application is still under review.ZYN is in violation of FDA’s regulations by selling in the market without authorisation.

- ZYN’s advertising issues, ZYN spends a huge amount of advertising money each year to promote the product on YouTube, TikTok, and Ins, these social media are commonly used by teenagers and young adults, and U.S. Senators are concerned that these advertisements for nicotine pouches are causing teenagers to overdose on nicotine. As a result, senators have advocated for increased laws and regulations on ZYN.

- Shortage of ZYN products, it was difficult to find ZYN products in the U.S., which led some ZYN users to switch to other brands of nicotine pouches, thus allowing ZYN’s market share to be eaten away by other brands.The shortage of ZYN was due to supply chain blockages; in addition, ZYN was suspected of illegally selling its products to minors, which is why Fillmore International halted the online sales of ZYN.

ZYN encountered the predicament in fact, many nicotine pouch brands will be or have been in the experience, which also gives the nicotine pouch practitioners some inspiration:

- It is important to communicate with the local sales countries and comply with local laws and regulations.

- The capacity of nicotine pouches is now in short supply.

- The market is relatively complex, new players still have the opportunity to obtain a certain market share.

The success of ZYN and its expansion in the marketplace significantly reflects a fundamental change in nicotine consumption patterns. The brand’s success is largely attributable to its dominant position in the market and rapid growth in sales, which reveals a growing consumer preference for healthier forms of nicotine intake.

However, ZYN’s popularity and growth has not been without its challenges, which include pressure from regulatory scrutiny and public concern over the possible effects of long-term nicotine bag use. In the U.S., nicotine pouch products are subject to strict regulation by the Food and Drug Administration (FDA), including age restrictions, nicotine health warning labels, and pre-market evaluation requirements.